- e-Invoicing Compliance News Blog

- How to connect to Peppol and ensure e-invoice compliance

How to connect to Peppol and ensure e-invoice compliance

Jul 06, 2021 08:45 PM

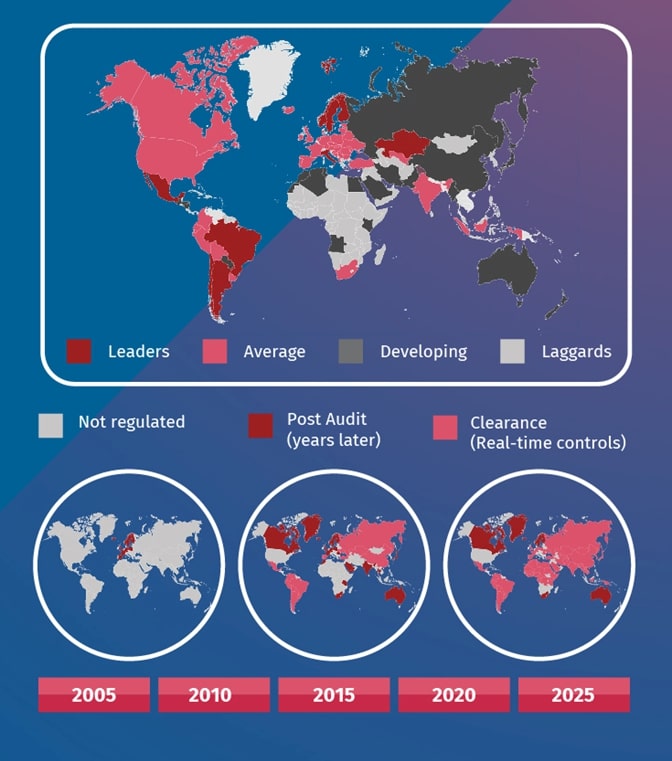

Electronic invoicing is no longer a trend – it’s the norm. With the spread of e-invoicing surging across the globe, with it comes a myriad of laws, mandates, and new electronic invoicing (e-invoicing) compliance requirements. When ensuring globally compliant B2B & B2G connectivity, e-invoicing through Peppol is quickly becoming a central business requirement. Read on to learn what Peppol is, and how the Basware Network helps to connect to Peppol.

Across the globe, countries are turning more and more towards e-invoicing. Why? Because the benefits speak for themselves. E-invoicing drastically reduces the cost of processing an invoice, decreases the likelihood of invoice disputes, eliminates manual entry errors, increases global tax compliance overall, reduces the reliance on paper processing, and therefore, creates a greener more sustainable workplace.

https://www.billentis.com/einvoicing_ebilling_market_overview_2021.pdf

E-invoicing is here to stay. While in the past, developments on the topic have largely been pushed by the private sector, there is an ongoing and notable shift towards governments driving the adoption of e-invoicing during the past years.

This can particularly be observed within the European Union: after the EU-wide harmonization of e-invoicing standards through EN16931, an increasing amount of EU member-states rely on the Peppol network’s specifications for the exchange of electronic business documents. Read on to learn more about Peppol, and what it means for your organization's compliance in e-invoicing.

What is Peppol and why is it important?

The Peppol Network is a common global framework for the cross-border exchange of electronic business documents. This means that Peppol is not a platform on which business documents such as invoices are exchanged – it is a network that connects many existing platforms, such as government platforms. Through this connection, the Peppol Network facilitates the exchange of business documents between various platforms. But even this description does not entirely do Peppol justice, since it’s much more than a mere network: Peppol is an entire set of rules and technical specifications to harmonize electronic business document formats and transmission standards.

In short, Peppol is neither only an e-invoicing format nor an e-invoicing platform: it is the full package when it comes to seamless and efficient B2G and B2B connectivity. Ensuring this connectivity is a challenge for both, buyers and suppliers alike, no matter the size of the organization. Already now, there are many local invoicing and procurement requirements and specifications all around the world, and Peppol plays an important role in this regard. Many transnational organizations sooner or later encounter Peppol access as a requirement:

-

Many countries trust the Peppol business validation rules for local invoicing mandates & rulings.

-

Peppol is also used in B2B connectivity and its importance here will grow over the years.

-

While Peppol is known to have a focus in Europe, it has in fact spread globally and is in active use in Australia, New Zealand & Singapore. There are Open Peppol members in 39 countries.

How to connect to the Peppol Network with Basware

Given all the above, connecting to the Peppol Network is a must for many organizations already now, and it will only become more relevant in moving forward. This is one of the reasons why the Basware Network follows an “open network philosophy”, meaning that it can easily connect to other networks, such as the Peppol Network.

In fact, Basware has been a central part of the Peppol development efforts since its very beginning. Going back to the late 2000s, Basware was the first official access point that sent the very first live transaction in the Peppol Network. Ever since, Basware has been an integral part in further developing and improving the Peppol Network with the strategic goal of compliant global B2B & B2G.

The Basware Network helps organizations connect to all customers and suppliers to send purchase orders, receive invoices electronically, and manage supplier data, ensuring global compliance with protocols such as Peppol, IDOC, cXML, UBL, EDIFACT, TEAPPS, Finvoice, OIOUBL, Svefaktura, and more.

“If your organization needs to transact across borders, these days Peppol can never be an afterthought. As an Access Point software implementer for the Peppol Access Points in the Oxalis Community I probably know better than most how important it is to have a resilient access system into the Peppol Network; it is a foundational aspect. In my years at Basware and as the main contributor and committer to the Oxalis code, it is exciting to see how the Basware Network and the Peppol Network connect to one another and communicate – this is cutting edge technology designed to clearly meet the requirements of organizations who transaction across the globe.” Arun Kumar, Chief Product Architect at Basware & The Oxalis Management Team Member(Elected)"

Whether your organization requires Peppol compliant invoice receipt, invoice sending, or procurement – the Basware Network enables Peppol connectivity on a global scale.

Basware helps overcome compliance challenges

As outlined above, Peppol is an important business requirement for organizations that transact globally. However, it’s merely a puzzle piece when it comes to the increasingly complex global e-invoicing landscape. Basware delivers a total e-invoicing solution, assisting you with all your compliance challenges from identifying obligations and assessing requirements to designing and managing solutions and keeping track of all the changes in the regulatory environment – on a global scale.

For years, Basware has been gathering regulatory and best practice knowledge from local markets, building new format conversions, connecting locally authorized compliance partners and tax authorities, and enabling the use of digital signatures and certificates. With this all under our belt, we can support your global organization through all aspects of compliance, covering both B2B and B2G connectivity.

As a global market leader in e-invoicing, Basware is the strongest partner to consider for your global e-invoicing compliance requirements. No matter your needs, Basware helps you cover all e-invoice delivery channels.

We provide a single source for global compliance by providing support in over 60 countries through our 200+ interoperability partners. We deliver multi-channel coverage combined with localized knowledge and connectivity to third parties.

So, how is it that we can provide all this for organizations worldwide? For starters, we’ve partnered up with the leading e-invoicing and tax compliance advisers and service providers, as well as with various local partners, to ensure our business network supports our customers for compliant e-invoicing where it’s needed the most. On top of that, Basware’s in-house compliance management works together with our service management team as well as with external advisers and authorities to maintain and improve the compliance support provided by the Basware Network.

Our network and its country coverage are growing constantly, ensuring organizations like yours with total compliance support. This frees organizations from the burden and complexity of global compliance and lets you focus on what matters – innovating the medical world.

As we discussed earlier, complying with global invoicing and tax mandates is complex and the consequences of non-compliance can be severe. But with Basware, you can automate your e-invoicing compliance across all B2G and B2B mandates that include different formats, processes, and archiving standards. You'll never lose sleep over compliance again as Basware supports you in your VAT compliance work in more than 50 countries and a certified Peppol access point.

Efficiency, compliance, and control – thanks to automation

At the end of the day, e-invoicing compliance isn’t easy. But when you let the experts support you, you gain efficiency, compliance, and control.

Efficiency.

-

Reduce the costs associated with handling global tax compliance.

-

Free resources from a large part of the burden and complexity of e-invoicing compliance to focus on core business.

Compliance

-

Minimize errors by providing up-to-date tax information.

-

Reduce the risk of financial penalties and other sanctions associated with non-compliance with regulations.

Interested in compliance related news and views?

Subscribe to our e-Invoicing Compliance News Blog

Basware does not provide tax, legal or accounting advice. This product compliance documentation is protected by Basware copyright, is made available for information purposes only, without any guarantee or warranty, is not binding upon Basware and can be updated by Basware at any time, without notice. This documentation is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.