- e-Invoicing Compliance News Blog

- Compliance update: Italy cross-border e-invoice reporting requirements from July 1st, 2022

Compliance update: Italy cross-border e-invoice reporting requirements from July 1st, 2022

Dec 13, 2021 09:45 PM

Electronic invoicing is no longer a trend – it’s the norm. With the spread of e-invoicing surging across the globe, with it comes a myriad of laws, mandates, and new electronic invoicing (e-invoicing) compliance requirements. Italy for instance has quite a strong history when it comes to governmental regulations on e-invoicing – which have been developing continuously.

Starting on January 1st, 2022, new regulations regarding cross-border invoices will apply. Read to learn how this attends your organisation’s invoicing processes to and from Italy, what to pay attention to, and how to best adhere.

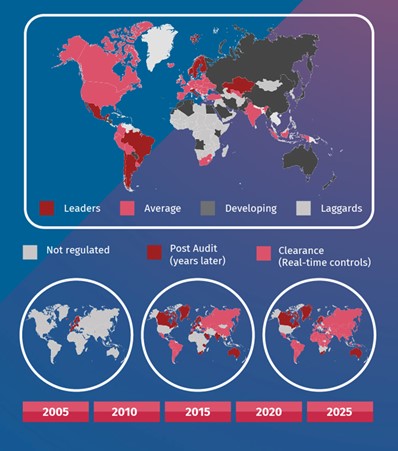

Across the globe, countries are turning more and more towards e-invoicing. Why? Because the benefits speak for themselves. E-invoicing drastically reduces the cost of processing an invoice, decreases the likelihood of invoice disputes, eliminates manual entry errors, increases global tax compliance overall, and reduces the reliance on paper processing, and therefore, creates a greener more sustainable workplace.

E-invoicing is here to stay. While in the past, developments on the topic have largely been pushed by the private sector, there is an ongoing and notable shift towards governments driving the adoption of e-invoicing during the past years.

This can particularly be observed within the European Union: after the EU-wide harmonisation of e-invoicing standards through EN16931, an increasing amount of EU member-states have been, and are, developing regulations for the exchange of electronic business documents such as invoices

New compliance requirements for cross border invoices to and from Italy

Without getting too technical, let’s get the basics right on what regulations on e-invoicing in Italy look like. The Italian Public Authority is represented by a single e-invoice service provider, SOGEI. SOGEI itself is interacting only with certified Exchange System providers (ES), and it is mandated that only the local Italian SdI-XML (FatturaPA) e-invoice format is a compliant e-invoice format. Now that we have gotten the basics out of the way, we bring the happy news: Basware is using local, certified, and accredited companies to comply with the Italian Public Authority's legal and technical requirements, both for e-invoicing as well as for e-archiving. But what are the changes coming in 2022?

In a nutshell, it looks like this: up until 2022, only domestic invoices had to be exchanged via a central governmental hub called SdI, the Sistema di Interscambio. For the e-invoice compliance audience out there: yes, it’s a clearance model. Cross-border invoices had to be disclosed only quarterly, and this is what’s changing now. Cross-border transactions will have to be reported to the SdI in the specific FatturaPA format. In practice, this does not mean that cross-border e-invoicing via the government platform is mandated – but the reporting of those transactions is.

This change was initially planned to take place on January 1st. This has very recently (December 2021) been postponed to a later date in 2022, a likely (but not yet officially confirmed) new date is July 1st, 2022.

Basware ensures compliance with these new requirements via our partner SATA, and through continuous connection improvements within the Basware Network. Basware supports the newly required document types TD16 and TD20 in both instances when invoices need to be sent or received.

Basware helps overcome compliance challenges

Basware delivers a total e-invoicing solution, assisting you with all your compliance challenges from identifying obligations and assessing requirements to designing and managing solutions and keeping track of all the changes in the regulatory environment.

In other words, we support you in all aspects of e-invoicing compliance.

For years, Basware has been gathering regulatory and best practice knowledge from local markets, building new format conversions, connecting locally authorised compliance partners and tax authorities, and enabling the use of digital signatures and certificates. With this all under our belt, we can support your global organisation through all aspects of compliance, covering both B2B and B2G connectivity.

As a global market leader in e-invoicing, Basware is the strongest partner to consider for your global e-invoicing compliance requirements. No matter your needs, Basware helps you cover all e-invoice delivery channels.

We provide a single source for global compliance by providing support in over 60 countries through our 200+ interoperability partners. We deliver multi-channel coverage combined with localised knowledge and connectivity to third parties.

So, how is it that we can provide all this for organisations worldwide? For starters, we’ve partnered up with the leading e-invoicing and tax compliance advisers and service providers, as well as with various local partners, to ensure our business network supports our customers for compliant e-invoicing where it’s needed the most. On top of that, Basware’s in-house compliance management works together with our service management team as well as with external advisers and authorities to maintain and improve the compliance support provided by the Basware Network.

Our network and its country coverage are growing constantly, ensuring organisations like yours with total compliance support. This frees organisations from the burden and complexity of global compliance and lets you focus on what matters – innovating the medical world.

As we discussed earlier, complying with global invoicing and tax mandates is complex and the consequences of non-compliance can be severe. But with Basware, you can automate your e-invoicing compliance across all B2G and B2B mandates that include different formats, processes, and archiving standards. You'll never lose sleep over compliance again as Basware supports you in your VAT compliance work in more than 50 countries and a certified PEPPOL access point.

Efficiency, compliance, and control – thanks to automation

At the end of the day, e-invoicing compliance isn’t easy. But when you let the experts support you, you gain efficiency, compliance, and control.

Efficiency

-

Reduce the costs associated with handling global tax compliance.

-

Free resources from a large part of the burden and complexity of e-invoicing compliance to focus on core business.

Compliance

-

Minimise errors by providing up-to-date tax information.

-

Reduce the risk of financial penalties and other sanctions associated with non-compliance with regulations.

Interested in compliance related news and views?

Subscribe to our e-Invoicing Compliance News Blog

Basware does not provide tax, legal or accounting advice. This product compliance documentation is protected by Basware copyright, is made available for information purposes only, without any guarantee or warranty, is not binding upon Basware and can be updated by Basware at any time, without notice. This documentation is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.