- e-Invoicing Compliance News Blog

- B2G e-Invoicing Mandatory in Luxembourg

B2G e-Invoicing Mandatory in Luxembourg

Oct 26, 2022 11:00 AM

Following other European countries, like its neighbors France and Germany, Luxembourg recently passed a law to make public sector (B2G) e-invoicing mandatory. Joining this inevitable trend enables companies to reduce the cost of processing invoices, decrease the likelihood of invoice disputes, eliminate manual entry errors, and increase global tax compliance.

What does the law say?

The Law of 13 December 2021 (amending the Law of 16 May 2019) provides the following obligations:

- For companies: to issue and transmit only electronic invoices, that is to say, XML files or files containing XML, which are compliant in the context of public procurement;

- For public-sector bodies: to use the common delivery network for the automated receipt of electronic invoices Peppol and, as long as they do not have their own access point to Peppol, the access point of the CTIE (Government IT Centre);

- For ministries and state administrations: to use the CTIE’s access point to Peppol.

When will e-invoicing be mandatory?

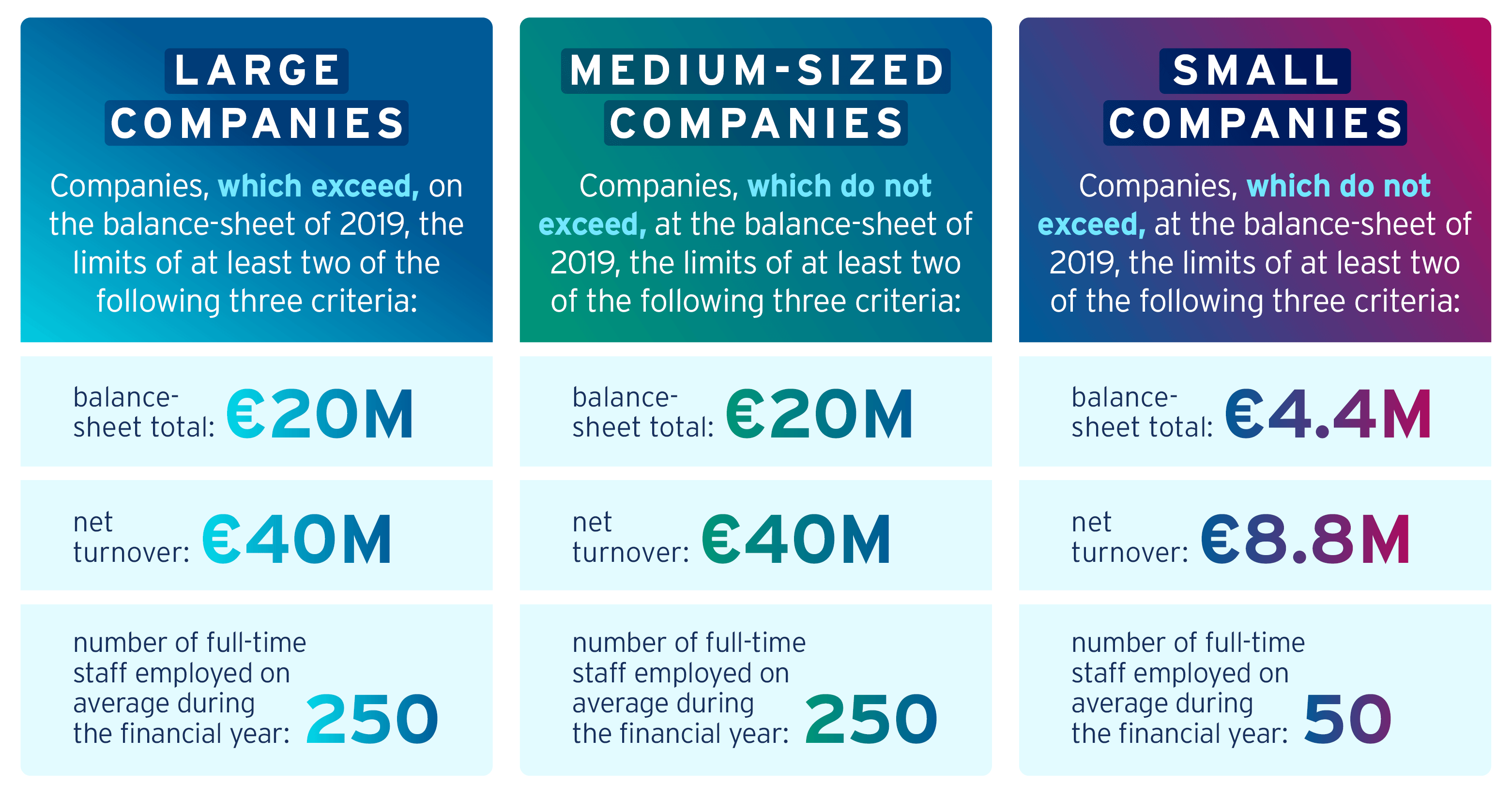

The following timelines are set by the law for companies to send e-invoices to public entities in Luxembourg:

- Large companies, 5 months after the entry into force of the law, i.e. on 18 May 2022;

- Medium-sized companies, 10 months after entry into force, i.e. on 18 October 2022; and

- Small and newly established companies, 15 months after entry into force, i.e. on 18 March 2023.

What delivery network supports this model?

The Peppol Network is a common global framework for the cross-border exchange of electronic business documents. Peppol connects many existing platforms which facilitate and enables the automated issue, transmission and receipt of electronic invoices. Not only does this document exchange between the buyer and the seller make things convenient and easy, but also secure and compliant.

The e-invoicing format used in Luxembourg is Peppol BIS 3.0. Basware has already started implementing large companies sending e-invoices to Luxembourg public entities via the Peppol Network. As a certified Peppol access point provider, Basware helps companies connect to the Peppol Network to send e-invoices in Luxembourg.

How Basware tackles global e-invoice compliance

Basware delivers a total e-invoicing solution, assisting you with all your compliance challenges from identifying obligations and assessing requirements to designing and managing solutions and keeping track of all the changes in regulatory environments.

We support you in all aspects of e-invoicing compliance – especially when it comes to the seemingly constant updates and developments of e-invoicing core standards to stay compliant with e-invoicing regulations across the globe. Complying with global invoicing and tax mandates is complex and the consequences of non-compliance can be severe.

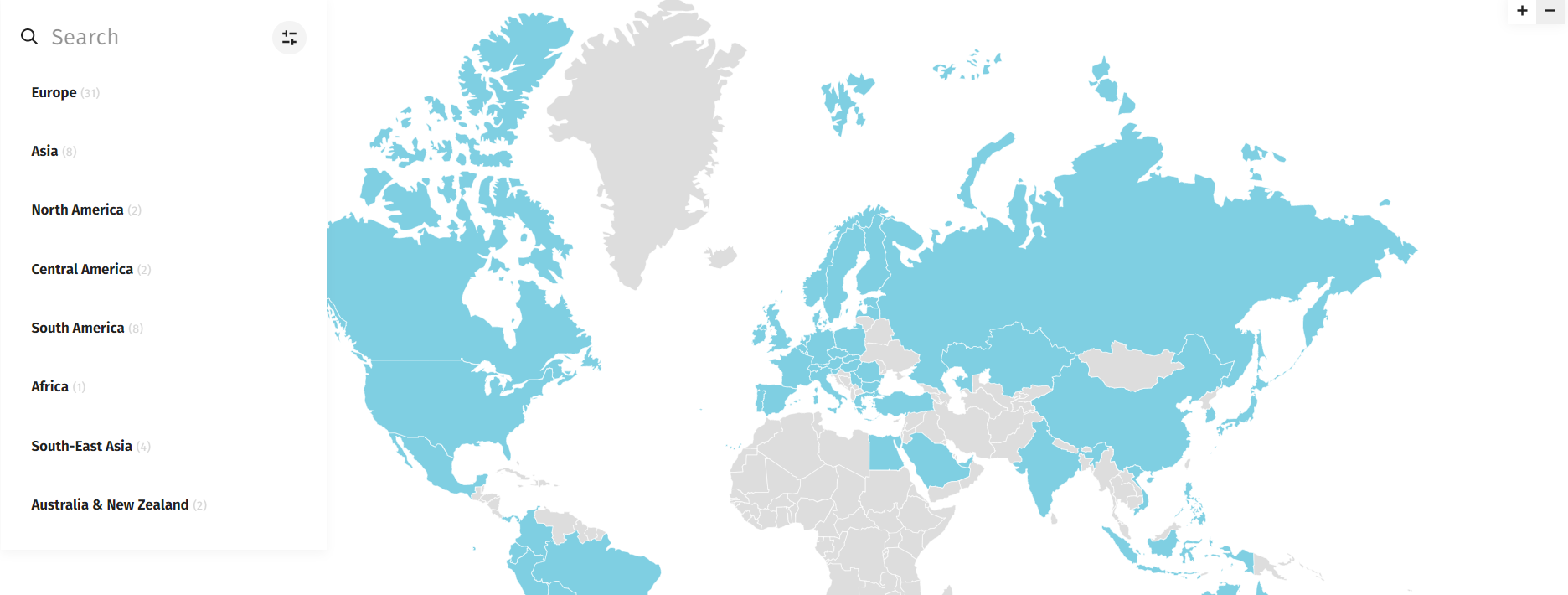

With Basware, you can automate your e-invoicing compliance across all B2G and B2B mandates that include different formats, processes, and archiving standards. As a certified PEPPOL access point, Basware supports you in your VAT compliance work in more than 50 countries, so you never lose sleep over compliance again.

GLOBAL E-INVOICING COMPLIANCE MAP

Basware is devoted to eliminating the burden and complexity of global compliance. Our Global e-Invoicing Compliance Map helps companies keep up-to-date on the complex, fragmented, and constantly changing environment of e-invoicing compliance.

More on e-invoicing benefits and trends

Download our e-book

To learn more about e-Invoicing and its vast spread across the globe download this e-book. We break down key considerations to ensure a successful transition from manual processes to paperless e-invoicing.

Basware does not provide tax, legal or accounting advice. This product compliance documentation is protected by Basware copyright, is made available for information purposes only, without any guarantee or warranty, is not binding upon Basware and can be updated by Basware at any time, without notice. This documentation is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.